Things You Need to Know About Credit Scores

A borrower’s creditworthiness is important for many financial institutions such as banks. This is determined through credit scores, which give banks a bird’s eye view of the borrower’s financial behavior.

Borrowers need to have attractive creditworthiness because this gives them good standing for existing and future financial decisions and goals. Whether one will need a home loan in the future for his family or a new credit card from another bank, credit scores are an important factor to establish a good relationship with financial institutions.

Below are the things you have to know about credit scores and how you can improve them to your advantage.

What is a credit score and what it is for?

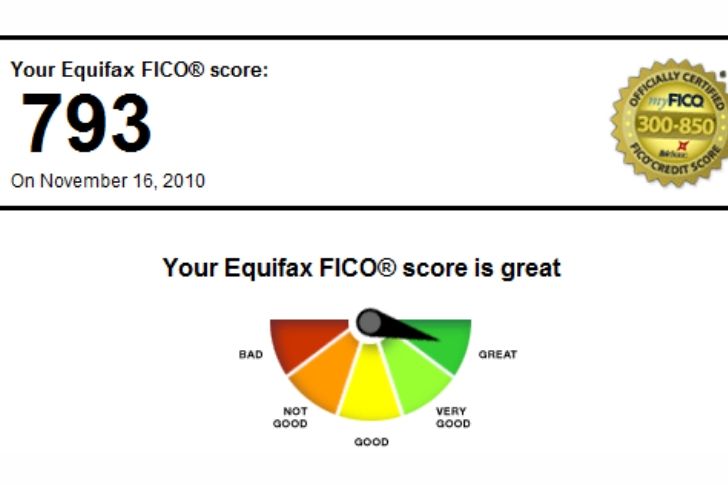

A credit score is a number that is based on the data mined information from your credit reports. Credit reports are being given by two major companies namely FICO or Fair Isaac Corp., and the VantageScore Solutions. Credit scores range from 300 to 850. These are sourced out as one of the deciding factors to approve financial applications such as housing loan, auto loan, or credit card application.

Credit scores range from 300 to 850, with the latter as the most exceptional level. When one has a credit score of 850, lenders find the borrower’s attractive. This gives him higher chances of getting his loans approved or having the best interest rates available. On the other hand, low credit scores would mean a red flag for lenders.

Different scores for different purposes

A credit score is not just one. Do not get confused if you have multiple credit scores. Credit scores vary depending on the credit bureau and the type of lending purpose needed. For example, there is a special FICO score for auto loan applications. There is also a different score for mortgages and credit cards.

What are the factors that affect your credit scores and how can I address them?

Your credit scores change from time to time. It depends on your performance as a responsible borrower. Here are some of the factors that can affect your scores.

Payment history

Late payments mean lower credit scores. Make sure to settle your bills on or before the given due date. Always take note of your deadlines for electricity, water, and other bills, as well as your credit card balances and other existing loans.

Availability of credit

If you are a credit card owner, make sure that you only have an average ratio for credit utilization. Do not let your credit card get maxed out as much as you can. It is advised to always leave at least 30 percent of your available credit limit to not leave a negative impression among the credit bureau. Do not go overboard in using credit cards.

Impressive credit history

If you are someone who has had a credit card for years and has been dutifully paying his debts to the bank for a while now, make sure you have a good track record. Lenders will always prefer people who have good-paying behavior.

How to know your credit scores?

Typically, getting access to the credit bureau as an individual requires a fee paid upfront. You can also access your FICO scores by purchasing them online. If you want to know your credit score without shelling out money, you can determine it by asking your existing credit card company to give you free credit scores. You can also ask for your credit score standing during the loan application.

Material based on The Balance

CafeCredit.com/Flickr

SunWayne/Flickr

IndiaLends/Flickr